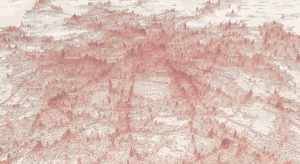

In previous articles we have already discussed what to consider when choosing a new location for a branch and which pitfalls to avoid. One key aspect in determining the success of a potential new shop is the environment. Do points of interest that attract visitors exist- if so, what kind of visitors? What other shops can be found here, are there competitors or complementary shops?

Competition vs. Agglomeration

It’s no coincidence that retail activity is usually clustered in city centers and secondary shopping areas. On the one hand, locating close to competitors leads to the so called “competition effect”, meaning higher price competition and hence lower revenues. On the other hand, competitor and complementary shops nearby increases the overall attractiveness of the area and therefore capture more consumers. This is known as the “agglomeration effect”.

The predominance of one effect over the other mostly depends on the type of business and especially on the possibility to differentiate the product that the business offers. For instance, gas stations offer a standard product where the price competition plays the most important role. Clothing shops offer instead a different range of products and can benefit from the presence of similar shops nearby.

This is not surprising, those who want to buy clothes will find a wider choice in a shopping area with several clothing shops. The other shops act as traffic magnets, attracting more potential customers who might not have visited the store otherwise. This makes clothing brands the prime example of retailers that benefit from the proximity of competitors. They not only help increase footfall in the area, they even attract the right clientele who are looking to buy.

Different types of clusters

This explains why the concept of “business clusters”, or more specifically, “shop clusters”, is extremely relevant in the retail sector. Shop clusters can be defined as a group of shops with similar or different characteristics that occur closely together. We at Targomo use four attributes to distinguish between different types of clusters:

- Size (small vs big clusters)

The cluster size is determined by the number of shops that constitute the cluster. Usually, the more shops the cluster can offer, the more visitors it is expected to attract.

- Diversity (homogeneous vs heterogeneous)

How many different categories of shops constitute the cluster? How many different categories of shops make up the cluster? Is it a fashion strip, do furniture outlets congregate here? Or is the cluster perhaps defined by complementary shops such as a pharmacy, supermarket and drugstore? Industry clusters in particular can have a very positive effect on shops in the same category.

- Price (expensive vs cheap)

What is the average price of the shops that form the cluster? As the saying goes, ‘Birds of a feather flock together’, and this can also apply to retail if they attract the same target groups. That’s why you usually see classy designer stores next to each other, but a jeweller only rarely next to a discounter.

- Brands (popular vs unpopular)

Do most well-known and popular brands compose the cluster, or independent shops and alternative designer labels? Here, too, like-minded shops often come together to define the character of a shopping street.

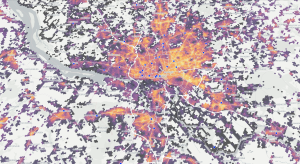

How clusters determine the footfall quality

Investigating the impact of different types of clusters provides retailers with highly valuable insights into which characteristics drive their business success and what they should look for when selecting their next site. In fact, it is not only a matter of the quantity of footfall, but more importantly about the quality of the footfall around a store.

To increase its profits, a business should locate itself in an area that attracts the right people. In other words, it should locate itself as close as possible to shops from which it could profit because they have the same target audience.

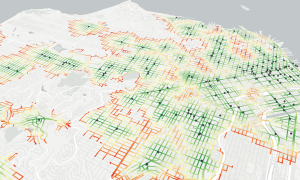

The value of cluster impact for sales projections

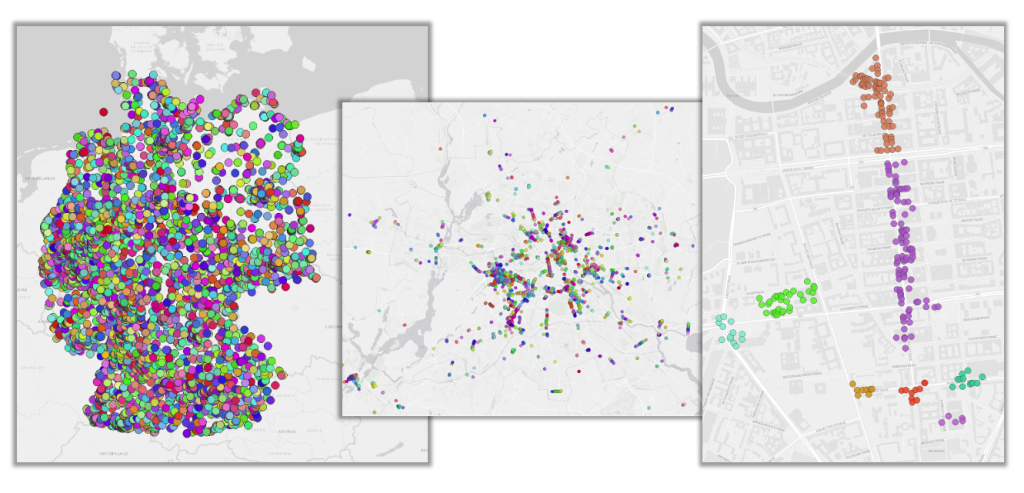

At Targomo, our ‘success driver’ analysis looks at whether, and to what extent, being part of a particular shop cluster has a positive effect on sales. If we can determine correlations, retailers not only know which location attributes they should look for when opening a new site, we can also determine the “weight” (e.g. importance) of these attributes. The weighted attributes can be integrated into our sophisticated Geo AI model – a prediction model developed to forecast relevant sales metrics for any potential site.

Our approach consists of three main steps:

- Creating clusters of shops based on the distance among shop POIs

- Computing several clusters’ attributes such as size, diversity, price and brand popularity depending on their characteristics

- Including the clusters and their attributes in our Geo AI prediction model

With Geo AI: The search for the “best neighbours”

The Geo AI prediction model then defines exactly which characteristics lead a location to success and to what extent the respective location characteristics are contributing to success. To give an example: The results of a recent case study showed us that for a home furnishing retailer, price was the most important cluster characteristic. The brand particularly benefited from having many high-priced shops nearby. With this in mind, the brand has additional criteria when looking for a profitable area to open a new shop, specifically which are its best neighbors and hence the kind of stores that help making its business more successful.

Author: Marta Fattorel is Spatial Data Scientist at Targomo. After graduating in Data Science at the University of Trento, she joined Targomo in Berlin to research the contribution of the various location factors to the turnover of the respective brands.